If your roof is damaged, it’s important to get it repaired right away, especially with Colorado’s winter weather fast approaching. Depending on the extent of the damage, however, it can be rather costly to repair. Financing a roof repair or replacement with emergency savings isn’t possible for many homeowners and paying with a credit card can be a risky alternative. At Elite Roofing & Solar, one of our top priorities is making sure our customers know about all the options available to them when it comes to roofing projects, and that especially includes financing a roof repair. So today, we’re talking about three solid roof financing options to consider if you’re in need of a major roof repair or replacement.

HELOC

One route for financing your roof repair or replacement is through a home equity line of credit. If you’ve built a fair amount of equity in your home – that is, if you’ve paid a substantial part of your mortgage – a home equity loan can be a cost-effective option. You’ll be able to borrow up to a certain portion of the equity you’ve built, and you’ll usually get more reasonable interest rates along with longer repayment periods than with a personal loan. The risk here, however, is that your home’s equity is used as collateral – so if you fall behind on payments, there can be steep consequences.

Personal Line of Credit

Another kind of loan for financing your roof is a personal loan. Typically, you could borrow far more than you would need for your repair, through a bank, credit union, or other financial institution. This doesn’t require any kind of collateral, but the primary drawback is that these loans tend to be short-term (most must be paid off within 2-5 years) and carry high interest rates, leading to much higher monthly payments. Still, if you can reliably make the payments on a personal loan, this can be a viable roof financing option.

Finance through your roofer

Many professional roofing companies partner with reputable lenders to make financing major roofing projects simpler. Payments can be spread out over several months or even years, and while interest is often charged, these rates tend to be lower than a home equity or personal loan, especially if their payment plans include a partnership with an FHA Title I lender. As with all loans, it’s important to make sure you’re comfortable with the monthly payments you’ll be making, so be sure to talk to your roofing company about their roof financing options before work begins.

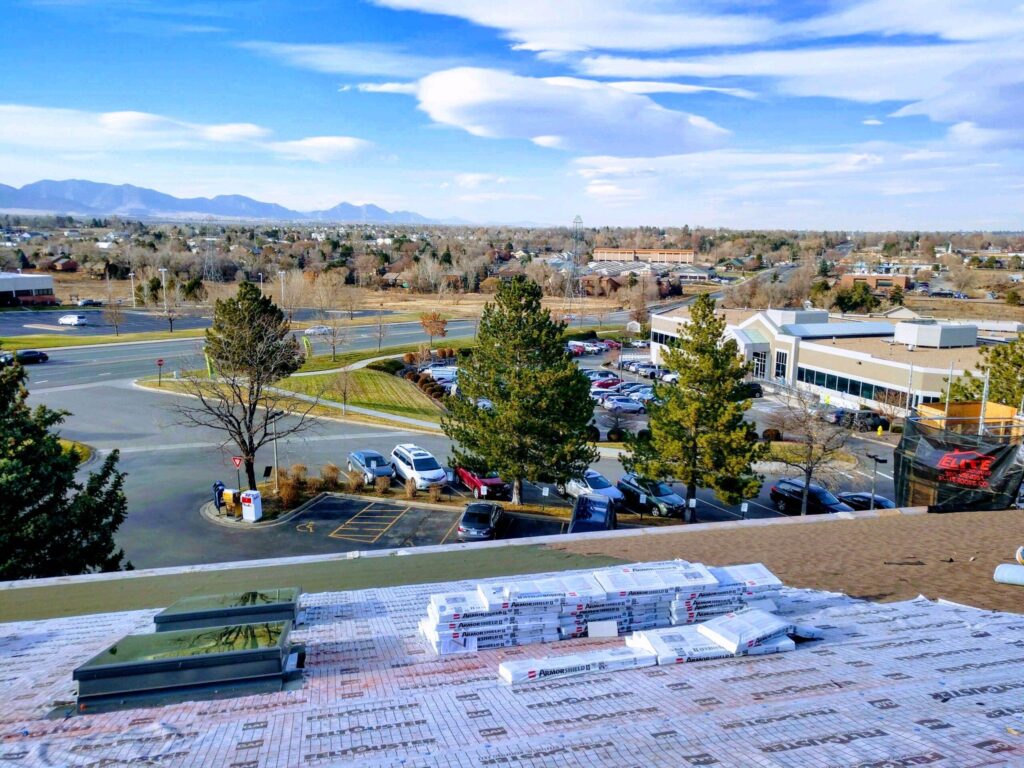

Elite Roofing & Solar Offers Roof Financing Options

At Elite Roofing & Solar, we understand that many roof repair jobs can be too expensive to finance out of pocket. Our team at Elite Roofing & Solar in Denver has made taking care of families our number one priority, so we’re proud to offer flexible roof financing options through our partner, a nationally licensed FHA Title I lender and sales financing company. Financing options include deferred payment plans, low monthly payments, and no payments or interest for the first six months. If your roof is in need of a major repair, contact us today! Our professional roofers have you covered, and our professional roof financing partner is here to help you – and your wallet – breathe easier.